Global Economic Risk

- The greatest risk to the global economy is that economic activity surprises on the upside in 2021.

- Currently consensus forecasts are for the global economy to grow 5.8% in 2021, lead higher by the US 5.7%, China 8.5%, and India 9.4%.

- Global economic consensus forecasts are likely to move higher as the year progresses, reflecting:

- economic activity surprises on the upside post COVID-19 vaccination reopening,

- which will be supported by very low interest rates and the expected continuation of accommodative policy by central banks for some time to come, and

- the very large government spending packages being rolled out. For example, the recently proposed $2.2 trillion spending package on infrastructure and other benefits over the next 10 years by President Biden in the USA, this is addition to $1.9tn spending stimulus he announced earlier in the year (American Rescue Plan).

- The size of the US government spending program is huge, $5 trillion in measures have been announced since March 2020, over 80% of this will be “spent” by the end of 2021. This does raise economic risks for the future and $2 trillion in tax increases is being planned.

Concerns over inflation overdone……………for the time being.

- Global interest rates have moved higher over the first three months of 2021 due to optimism over the rollout of the COVID-19 vaccine, better than expected economic data, the highest level of US government spending outside of war times, and the US Federal Reserves’ commitment to maintaining easy policy settings until higher inflation is sustainable.

- Arguably interest rates have risen on a growth scare, rather than an inflation scare.

- For the time being inflation is not a major issue and is probably not likely to be so for some time given “under-employment” (spare capacity) within the US, and global, economy.

- Inflation in the US is expected to spike in the months ahead, this will reflect base effects from the shock to measures of inflation 12 months ago.

- Albeit the risks to inflation are rising and higher inflation is likely to be an issue by the middle of the current decade, resulting in central banks raising interest rates.

- From a portfolio construction perspective, investors with a longer-term view should reduce portfolio duration and start considering the allocation to inflation linked bonds and real assets (such as property and infrastructure).

- Either way, the outlook for fixed income is not encouraging in either the short or longer term, and particularly relative to returns experienced over the last 10-20 years.

- In the US, the 10-year government bond yield recently reached its highest level since January 2020, trading at 1.77%, this compares to 0.62% a year ago and a low of 0.55% in August of 2020.

- In New Zealand, the 10-year Government Bond yield finished March 2021 at 1.76%, the highest month end level since May 2019, and over 1% higher than the May 2020 low of 0.6%.

US 10-Year Government Bond Yield

Vaccine and Economic Data

- By the end of the first Quarter of 2021 61% of the population had received their first vaccine shot in Israel, this compares to 46% in the UK, 30% in the US and 12.6% across Europe.

- The daily pace of new doses administered is approximately 1.5m in the European Union, 2.8m in the US, and 0.5m in the UK.

- Economic data has surprised on the upside, particularly in the US where the reopening of the economy is accelerating economic activity:

- The number employed in the US grew by 916k in March, well above consensus forecasts. The unemployment rate dropped to 6.0%, from 6.2%, with an increase in the participation rate restricting a larger decline in the unemployment rate.

- US Consumer confidence also increased by a much larger amount in March than anticipated.

- Expectations for US manufacturing activity increased by more than expected and reached the highest level since 1983.

- A measure for US services sector activity also exceeded expectations.

- Likewise, measures of economic activity in the Euro Zone and China have recorded stronger than expected numbers.

- European measures of expected manufacturing activity are at all-time highs.

- China’s industrial profits have grown by 179% from last year, reflecting the low base of 2020 but also the very strong increase in revenues and profits over the last 12 months.

- While China is further advanced in its economic recovery, Europe lags both China and the US, nevertheless, the ongoing vaccine roll out and an increase in government spending should see the Euro Zone’s economy strengthen over the second half of 2021.

- The US Federal Reserve (Fed), unsurprisingly, has upgraded their economic forecasts significantly reflecting the above factors, specifically larger than expected government spending and the improving public health situation.

- The Fed also see inflation temporarily rising above 2% in the near term and then to settle to around 2% until 2023, they see the risks to inflation as balanced.

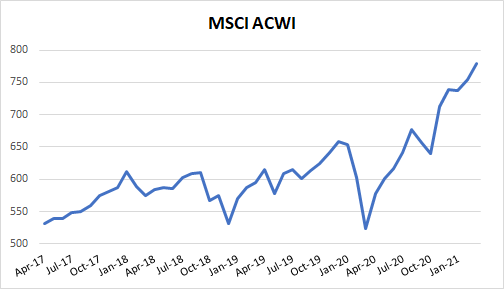

Market Performance

- The above environment has been good for global equity markets, but not so good for global fixed income markets.

- Base effects are also impacting Global Equity Market returns, as highlighted in the Table below.

- As can be seen, global equities have returned nearly 50% over the last year, in part reflecting markets reached their lows in March 2020 amidst the global COVID-19 pandemic.

| MSCI ACWI | MSCI EM | |

| 12 Months | 48.7% | 53.0% |

| 6 Months | 18.6% | 20.6% |

| 3 Months | 5.5% | 4.0% |

| 1 Month | 3.3% | -0.9% |

- The strength of the rebound since last year is very evident in the following graph.

- Emerging markets have outperformed developed markets over the last year despite underperforming over the first quarter of 2021.

- Over the first three months of 2021, European markets climbed 8.7%, the US 5.8%, Australia +4.3% and New Zealand fell 4.0%.

- In the fixed income markets, the NZ Government Bond Index fell 3.2% for the March Quarter, Aussie fixed income declined 3.5%. Smaller declines were experience in global fixed income.

- As a general trend, value continued to outperform momentum and the financial and energy sectors did well. The Real Estate and Utilities sectors tended to lag the broader market.

- The US dollar has been stronger relative to most currencies recently, reflecting firmer US economic growth and rising bond yields.

- Commodity prices have also been strong, the Dow Jones Commodity Index return 8.4% over the first three months of 2021.

Please read my Disclosure Statement