Key Developments over the Quarter

- Regulatory approval of Covid-19 vaccine and commencement of global immunisation program

- Democrat Party’s eventual control of Presidency, Senate, and House of Representatives will provide further support to the US economy from an increase in government spending

- US Federal Reserve’s decision to adopt a more flexible “average inflation targeting” policy

In recent months there has been a tug of war between rising Covid-19 infections and the development, approval, and initial distribution of a Covid-19 vaccine.

Increasingly the roll out of the vaccine will win this battle, helped by increased spending in the US and ultra-low interest rates around the world. This is supportive of global economic activity and sharemarkets in 2021.

Key Risks

- The Covid-19 vaccines are less effective than anticipated, particularly given existence of different strains

- The US Federal Reserve change their policy settings earlier than expected

- US consumers are cautious preferring to save rather than spend more of their $2,000 government handout

- There is the risk that global economic activity surprises on the upside in 2021

Portfolio Considerations

- Prefer equities over fixed income on a 12 – 18 months time horizon

- Shorten duration exposures of portfolios

- Emerging markets, cyclicals, and value to outperform

- Any sharemarket pull-back should be seen as an opportunity to add too equities

- Start preparing portfolios for a period of higher inflation

Effective and efficient implementation of investment strategies key.

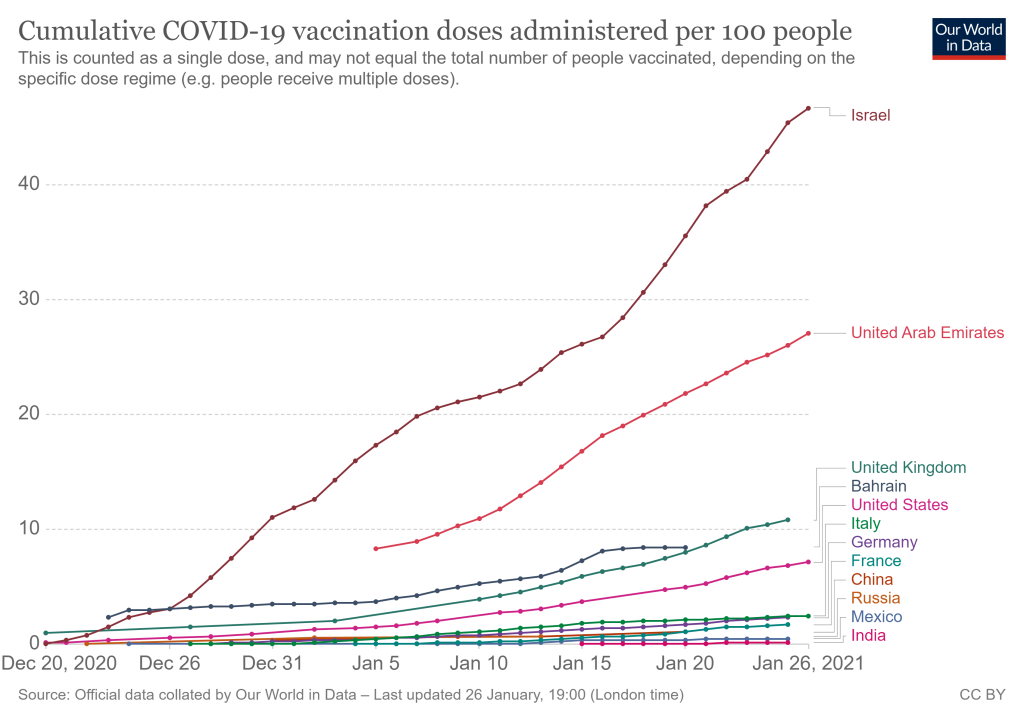

Vaccine Roll Out

A successful vaccine has been developed in record time, less than one year. The previous record for the fastest time to develop a vaccine occurred in the late 1960s when it took four years to develop a vaccine for the mumps.

More than 68 million vaccine doses had been administrated in 56 countries by late January 2021. The daily rate is approximately 3.4 million doses a day. Israel is leading with 43% of their population vaccinated. America has given out 23.5 million doses, 7.1% of their population.

A World Health Organisation linked plan is in place to administer 2 billion vaccine doses globally in the first half of 2021. Expectations are for large portions of the population to be vaccinated by the middle of 2021.

Goldman Sachs forecast: The UK is expected to vaccinate 50% of its population by the end of March, with the US and Canada following in April. The EU, Japan, and Australia reach the 50% threshold in May.

These targets are likely given the expected ramping up of vaccine production over the months ahead and despite a slower start to the vaccine roll out than expected in some countries.

Albeit virus cases and deaths have reached new records and new variants of the virus have emerged in the UK, Ireland, and South Africa. This wave of infections across the world, particularly in Europe and the UK, has resulted in renewed lockdowns and ongoing restrictions on activities.

As a result, global economic activity is expected to be weaker over the last quarter of 2020, after a strong rebound in the third quarter of last year. This weakness is expected to flow over into the New Year, 2021, given the above and that it has been a harsh northern winter. This is reflected in recent economic data. For example, the US economy expanded at a 4% annualised rate in the fourth quarter of 2020, which was below expectations and down from the record 33.4% annualised rate in the previous three months.

However, once the vaccine rollout gathers speed the reopening of economies will accelerate around the world.

Democrats win Georgia Senate elections

The outlook for 2021 is positive and received a boost following the Democrats taking control of the US Senate by the slimmest of margins after winning both seats in the Georgia run-off elections held in early January.

President Biden has released his $1.9 trillion (over 8% of the economy) Covid-19 Relief package, this is in addition to the $900 billion of spending approved by Congress in December. The plan includes $1,400 in additional direct payments to individuals (raising cheques to $2000) and aid to small businesses.

The relief package aims to provide economic support until the threat of the pandemic has receded.

There are political risks around getting the complete packaged passed in to law. Albeit, a sizeable percentage of the package is likely to be passed into law, which will represent a sizable stimulus for the US economy.

The extra spending along with ultra-low interest rates argues well for the global and US economy.

Interest rates are likely to remain low for some time.

US Federal Reserve Policy Position

The US Federal Reserve (Fed) will now seek to achieve average inflation of 2% over time. Instead of targeting a 2% inflation rate, the Fed will allow higher inflation “for some time” to offset below 2% periods of inflation.

They will also target “broad and inclusive employment”, where employment is placed ahead of inflation in terms of policy priority.

This is a dramatic change in policy and has implications for financial markets now and in the future.

The key short-term impact, interest rates in the US are expected to remain lower for longer. Specifically, the Fed will likely keep the Feds Fund Rate at the currently level of 0.25% until after there has been a period of inflation above 2%. And this is not likely to happen until late 2024 – early 2025.

Longer-term, the risks to containing inflation have increased. Likewise, longer-term interest rates will likely drift upward in anticipation of higher inflation and as the Fed scales back on other areas of their Policy response, such as the buying of fixed income securities (tapering of Quantitative Easing Policy).

With regards to US inflation, core consumer prices have risen 1.6% over the last year in the USA.

Although inflation is expected to be well contained over the next few years, the risks of higher inflation in the future are mounting, particularly given the size of the government spending being undertaken in the US.

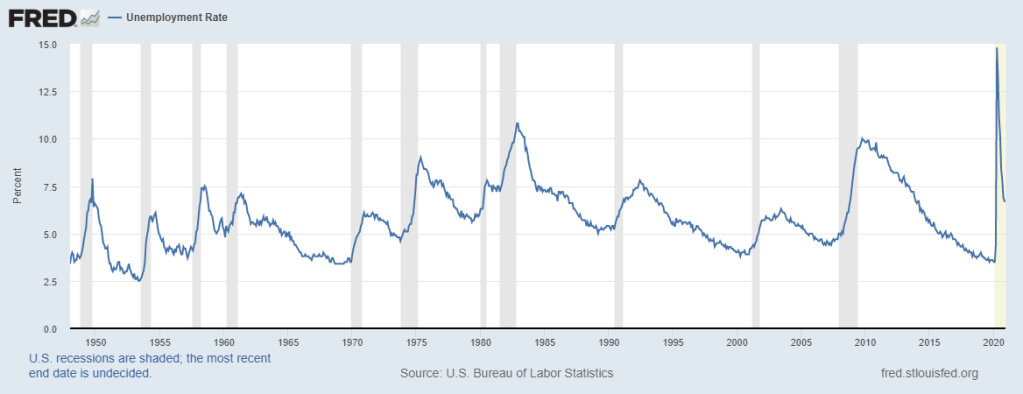

Although there might be some volatility in the inflation rate over 2021, reflecting the extreme disruption to the economy last year, core inflation is set to remain low given the level of spare capacity within the economy. By way of example, as presented in the graph below, US unemployment remains high despite a breathtaking recovery over the second half of 2020. The US unemployment rate is currently 6.7%. This compares to 14.8% at the end of April 2020 and 3.5% at the beginning of the year.

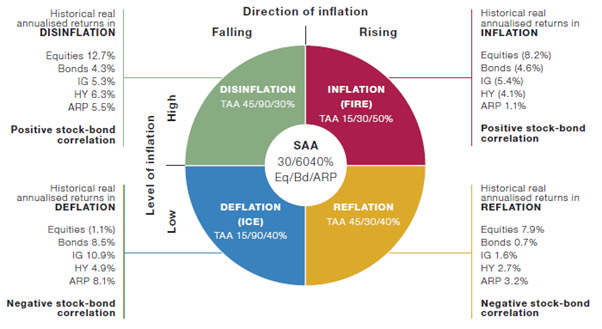

Nevertheless, the global economic environment is transforming to a more reflationary phase. This compares to the deflationary environment that has dominated the global economy since 2008 and the Global Financial Crisis (GFC).

As outlined in this Kiwi Investor Blog Post, investors are well advised to consider preparing their portfolios for the potential of a higher inflation environment.

Economic Outlook

The global economy is poised to rebound strongly in 2021, primarily driven by the factors outlined above, vaccine roll out, ultra-low interest rates, and government spending measures.

For the first time in over 10 years, we are likely to see strong and synchronised global economic growth over the years ahead.

The consensus forecast for world economic growth in 2021 is just over 5%, and approximately 4.0% in 2022. The global economy shrank 4.2% in 2020.

The V shape economic recovery is well on track around the world.

Given the Democrats win in Georgia as outlined above, economic growth forecasts for the US have been revised upwards recently on an expected increase in government spending. Consensus forecasts are for just over 4.0% growth in 2021, after a decline of 3.5% in 2020.

Many areas of the US economy are expected to perform well in 2021, including consumer spending, a rebound in capital expenditures, a strong housing market, and inventory rebuilding. Given above potential economic growth this year the level of unemployment should decline, reducing the slack in the US labour market.

The US economy has remained resilient in the face of the pandemic, with businesses learning to adapt to restrictions on activities. There is little evidence of economic scaring that would have negative longer-term impacts on economic activity.

This argues well for the US and risks to economic activity in 2021 could well be to the upside.

The Chinese economy rose 6.5% in the last quarter of 2020 from a year earlier. A strong outcome to finish the year and resulted in the Chinese economy growing 2.5% last year, the only major economy to report positive economic growth for 2020. Albeit this is the country’s weakest annual economic expansion since the late 1970s.

China is more advanced in its economic cycle post Covid relative to the rest of the world. The rebound in the economy is being driven by industrial production, exports, retail sales, and investment into fixed assets. Like the rest of the world, economic activity remains weak in tourist related industries, such as hotels and catering.

Around the rest of the world the Eurozone is expected to grow around 4.6% in 2021 after the sharp -7% contraction in 2020. The UK economy, which suffered one of the sharpest declines in 2020, estimated to have contracted by -11.2%, is on track to rebound in 2021 with over 5% GDP growth. The Japanese economy is expected to grow by around 2.5% in 2021.

The New Zealand economy expanded a stronger than expected 14% in the third quarter of 2020. This follows a historical 11% contraction in the second quarter. The economy is 2.2% smaller compared to a year ago. Construction and retail trade led the recovery following the second quarter lockdown. Accordingly, there has been an improvement in business confidence.

Inflation in the final quarter of 2020 was 0.5%, which was stronger than expected. Annual inflation was unchanged at 1.4%. The quarterly result in part reflects strong demand in some areas (e.g. accommodation and air travel) due to pent up demand following lockdown, supply issues in other sectors, and rising prices for housing construction.

Some volatility in inflation data can be expected in the quarters ahead, and Central Banks, such as the Reserve Bank of New Zealand, will look through this volatility.

In relation to New Zealand, a strong rise in house prices over the last three months of 2020 has reduced the likelihood of negative cash rates.

This turn of events has witnessed a steady appreciation of the New Zealand dollar (Kiwi) over the last quarter. The Kiwi is currently trading at around 72 cents versus the US dollar, compared to 67 cents at the end of September (+6%), and is 18% higher compared to 60 cents at the end of April 2020.

Brief Market and Portfolio Positioning Comments

- Global equities climbed over 17% in the December 2020 Quarter, to finish the year 16.9% higher than at the end of 2019.

- The US sharemarket ended the year at historical highs. The S&P500 returned 18.4% in 2020 and is over 70.0% higher from its yearly lows in late March.

- The New Zealand sharemarket also finished the year strongly, rising 16.3% in the last quarter of the year, returning 14.7% in 2020. This is the Index’s ninth consecutive year of positive returns. The benchmark has more than quadrupled since the end of 2011, and more than doubled since 2015 (benchmark returns are based on S&P Dow Jones Index data).

- The Australian sharemarket returned 13.7% over the last three months of 2020, eking out 1.4% for the year.

- Information Technology and Consumer Discretionary tended to be the better performing sections, Energy and Real Estate sectors the worst.

- Growth factor outperformed Value by a wide margin in 2020, as is has for some time. In the US, growth returned 33.5% and value 1.4% for the 12 months period.

- Nevertheless, this hides a sharp reversal in market fortunes over the last quarter of 2020, in the US value returned 14.5% and growth 10.7%, enhanced value returned 24.6% for the period.

- This reversal in market leadership has some legs and likely has further to run, given the economic backdrop outlined above.

- Likewise, cyclicals and the energy sectors will benefit from stronger global growth and the releasing of pent-up demand as economies open-up following the roll out of the vaccine.

- After 10-years of underperforming Development Markets, Emerging Markets are better placed to benefit from an increase in global manufacturing. These markets recently reached historical highs; surpassing levels last seen in 2007.

- Within portfolios duration should be reduced.

- The ultra-low interest rate environment presents challenges for investors in the years ahead. Over reliance on cash, fixed income, and equities to generate portfolio returns could lead to disappointing outcomes. Investors should look to increasingly diversify outside of the traditional asset class. This Post by Kiwi Investor Blog provides access to discussions on different portfolio investment strategies than could be considered in meeting the challenges ahead.

Global sharemarkets have performed strongly in recent months and are susceptible to a pull back.

Given the economic backdrop outlined above, this would provide an opportunity to consider adding to equity positions.

Please read my Disclosure Statement