As you will know the US economy is into its second longest period of economic expansion which commenced in June 2009.

Should the US economy continue to perform until July 2019, which appears likely, the US will enter its longest period of economic expansion. The longest expansion was 10 years, occurring during the tech expansion of the 1990s, the current expansion is nine years.

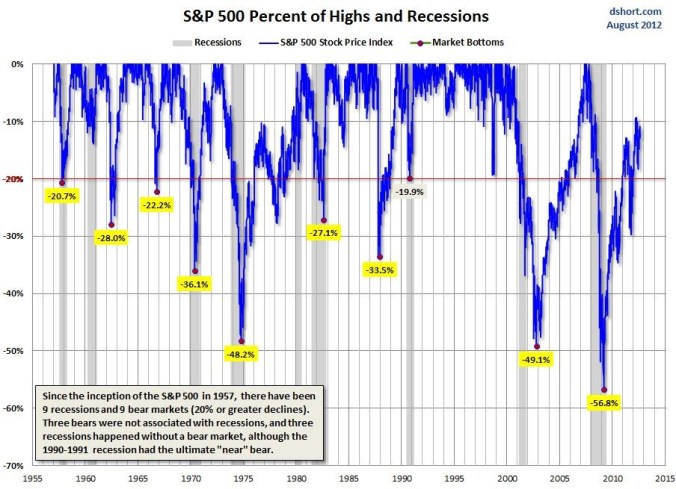

Similarly, the US sharemarket is into its longest bull market run, having not experienced a drop-in value of greater than 20% (bear market) since March 2009.

As a rule, sharemarkets generally enter bear markets in the event of a recession.

Nevertheless, while a recession is necessary, it is not sufficient for a sharemarket to enter a bear market.

Since 1957, the S&P 500, a measure of the US sharemarket:

- three bear markets where “not” associated with a recession; and

- three recessions happened without a bear market.

Statistically:

- The average Bull Market period has lasted 8.8 years with an average cumulated total return of 461%.

- The average Bear Market period lasted 1.3 years with an average loss of -41

- Historically, and on average, equity markets tend not to peak until six – twelve months before the start of a recession.

Therefore, let’s look at some of the Recession indicators.

In a recent article by Brandywine, they ran through some of the key indicators for a US recession.

Federal Reserve Bank of Atlanta’s GDP Nowcast.

This measure is forecasting annualised economic growth of 4.4% in the third quarter of 2018. This follows actual annualised growth of 4.2% in the second quarter of 2018.

Actual US economic data is strong currently. Based on the following list:

- US unemployment is 3.7%, its lowest since 1969

- Consumer Confidence is at an 18 year high

- US wages are growing at around 3%, the savings rate is close to 6%, leaving plenty of room for consumers to increase spending

- Small business confidence is at all-time highs

- Manufacturing and non-manufacturing surveys are at their best levels for some time (cycle highs)

Leading Indicators

The Conference Board’s Index of Leading Indicators, an index of 10 components that includes the likes of the ISM New Order Index, building permits, stock prices, and the Treasury yield curve.

The Conference Board’s Index is supportive of ongoing economic activity in the US.

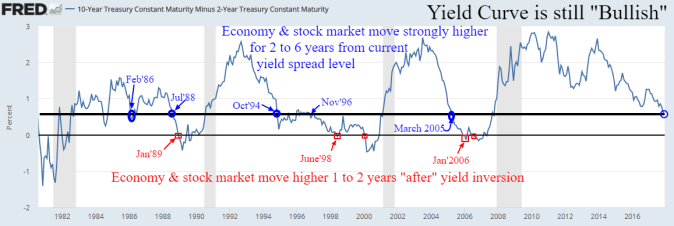

Yield Curve

The shape of the yield curve, which is normally upward sloping, meaning longer term interest rates are higher than short term interest rates, has come in for close attention over the last six months. I wrote a about the prospect of a negative yield curve earlier in the year.

An inverted yield curve, where shorter term interest rates (e.g. 2 years) are higher than longer term interest rates (e.g. 10 years) has a pretty good record in predicting a recession, in 18 months’ time on average.

With the recent rise of longer dated interest rates the prospect of an inverted yield curve now looks less likely.

Albeit, with the US Federal Reserve is likely to raise short term interest rates again this year and another 3-4 times next year the shape of the yield curve requires on going monitoring.

Having said that, an inverted yield curve alone is not sufficient as a predictor of economic recession and needs to be considered in conjunction with a number of other factors.

Brandywine conclude, “what does a review of some well-known recession indicators tell us about the current—and future—state of the U.S. expansion? The information provided by the indicators is mixed, but favors the continuation of the current expansion. The leading indicators are telling us the economy should continue to expand well into next year—at least.”

In favour of ongoing economic expansion is low unemployment, rising wages, simulative financial conditions (e.g. low interest rates are supportive of ongoing growth, as are high equity prices), high savings rate of consumer and their low levels of debt. Lastly government spending and solid corporate profitability is supportive of economic activity over the medium term.

As a word of caution, ongoing US – China trade dispute could derail global growth. Other factors to consider are higher interest rates in combination with a higher oil price.

Noting, Equity markets generally don’t contract until interest rates have gone into restrictive territory. This also appears some time away but is a key factor to monitor.

Lastly, a combination of higher oil prices and higher interest rates is negative for economic growth.

I have used on average a lot in this Post, just remember: “A stream may have an average depth of five feet, but a traveler wading through it will not make it to the other side if its mid-point is 10 feet deep. Similarly, an overly volatile investing strategy may sink an investor before she gets to reap its anticipated rewards.”

Happy investing.

Global Investment Ideas from New Zealand. Building more Robust Investment Portfolios.

Please see my Disclosure Statement