For those near retirement this year’s global pandemic has thrown up new challenges for them and their Financial Advisor.

Early retirement due to losing a job, the running down of emergency funds, and a low interest rate environment are new challenges facing those about to retire.

Events this year are likely to have significant repercussions for how individuals conduct their financial planning. Specifically, how they approach spending and saving goals.

The pandemic will likely have lasting implications for how people think about creating their financial and investment plans, and therefore raises new challenges for the Advisors who assist them.

These are the key issues and conclusions outlined by Christine Benz, director of personal finance for Morningstar, in her article, What the Coronavirus Means for the Future of Financial Planning.

In relation to the key issues identified above, Benz writes “All of these trends have implications for the way households—and the advisors who assist them—manage their finances. While the COVID-19 crisis has brought these topics to the forefront, their importance is likely to persist post-pandemic as well.”

Although the article is US centric, there are some key learnings, which are covered below.

How the Pandemic Has Impacted Financial Planning for Emergencies

The Pandemic has highlighted the importance of emergency funds as part of a sound financial plan and the difficulties that many individuals and households face in amassing these “rainy-day funds.”

Lower income families are more at-risk during times of financial emergencies. Research in the US found that only 23% of lower-income households had emergency funds sufficient to see them through three months of unemployment. This rises to 52% for middle income households.

It is advisable to have emergency funds outside of super.

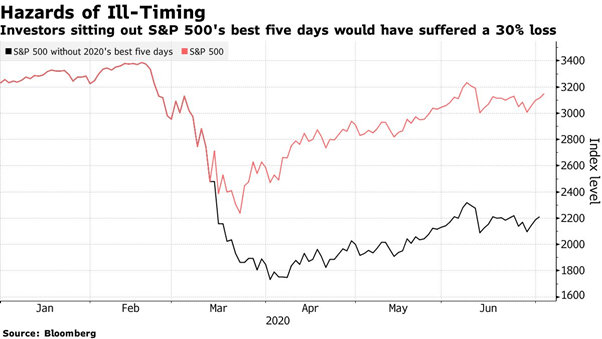

The Morningstar article highlights “Withdrawing from retirement accounts is suboptimal because those withdrawn funds can’t benefit from market appreciation—imagine, for example, the worker who liquidated stocks from a retirement account in late March 2020, only to miss the subsequent recovery.”

An emergency fund helps boost peace of mind and provides a buffer and the confidence to maintain longer-term retirement goals.

Financial Advisors can assist clients in setting saving goals to amass an emergency fund, which is specific to their employment situation, and how best to invest these funds so they are there for a rainy day.

From an industry and Policymaker perspective, and reflecting many households struggle to accumulate emergency reserves, Morningstar raised the prospect of “sidecar” funds as potentially part of the solution.

Sidecars “would be for employees to contribute aftertax dollars automatically to an emergency fund. Once cash builds up to the employee’s own target, he could direct future pretax contributions to long-term retirement savings. Automating these contributions through payroll deductions may make it easier for individuals to save than when they’re saving on a purely discretionary basis.”

The concept of sidecar funds has recently been discussed in New Zealand.

Financial Planning for Early Retirement

The prospect of premature retirement will pose an urgent challenge for some clients.

Although those newly unemployed will consider looking for a new job some may also consider whether early retirement is an option.

The US experience, to date, has been that those workers 55 and older have been one of groups most impacted by job losses.

Morningstar highlight that early retirement is not always in an individual’s best interest, actually, working a few years longer than age 65 can be “hugely beneficial to the health of a retirement plan,”….

They note the following challenges in early retirement:

- Lost opportunity of additional retirement fund contributions and potential for further compound returns; and

- Earlier withdrawals could result in a lower withdrawal rate or reduce the probability the funds lasting through the retirement period.

Financial Advisors can help clients understand the trade-offs associated with early retirement and the impacts on their financial plans. Often the decision to retire is about more than money.

Individual circumstances in relation to access to benefits, pensions, health insurance, and tax need to be taken into consideration. Given this, a tailored financial plan, including the modelling of retirement cashflows on a year-to-year basis would be of considerable value.

Accommodating Low Yields in a Financial Plan

The low interest rate (yield) environment is a challenge for all investors.

Nevertheless, for those in retirement or nearing retirement is it a more immediate challenge.

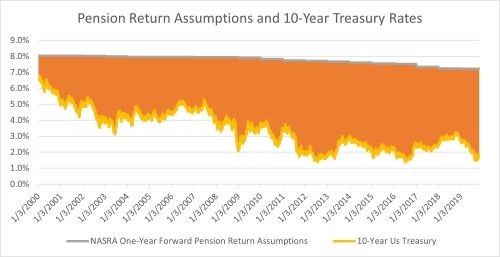

Return expectations from fixed income securities (longer dated (maturity) securities) are very low. Amongst the best predictor of future returns from longer dated fixed income securities, such as a 10-year Government Bonds, is the current yield.

In the US, the current yield on the US Government 10-year Treasury Bond is not much over 1%, in New Zealand the 10-Year Government Bond yields less than 1%. Expected returns on higher quality corporate bonds are not that much more enticing.

As Morningstar note, “These low yields constrain the return potential of portfolios that have an allocation to bonds and cash, at least for the next decade.“

The low yield and return environment have implications as to the sustainability of investment portfolios to support clients throughout their retirement.

The impact of low interest rates on “withdrawal rates” is highlighted in the graph below, which was provided by Morningstar in a separate article, The Math for Retirement Income Keeps Getting Worse, Revisiting the 4% withdrawal rule.

The 4% withdrawal rate equals the amount of capital that can be safely and sustainably withdrawn from a portfolio over time to provide as much retirement income as possible without exhausting savings.

For illustrative purposes, the Morningstar article compares a 100% fixed income portfolio from 2013 and 2020 to reflect the impact of changes in interest rates on the sustainability of investment portfolios assuming a 4% withdrawal rate.

As Morningstar note, since 2013 investment conditions have changed dramatically. When they published a study in 2013 the 30-year Treasury yield was 3.61% and expected inflation was 2.32%. Investors therefore received a real expected payout of 1.29%.

When they refreshed the study in 2020, those figures are 1.42% and 1.76%, respectively. This implies a negative expected return after inflation.

The graph below tracks the projected value of $1 million dollars invested in 2013 and 2020. The prevailing 30-year Treasury yields for July 2013 and October 2020, as outlined above, are used to estimate income for each portfolio, respectively, over time. A “real” 4% withdrawal rate is assumed i.e. the first years $40k withdrawal grows with the inflation rates outlined above.

As can be seen, the 2013 Portfolio lasts up to 30 years, the 2020 Portfolio only 24 years, highlighting the impact of lower interest rates on the sustainability of an investment portfolio.

Financial Advisors can help in determining the appropriate withdrawal rates from an investment portfolio and the trade-offs involved. They may also be able to suggest different investment strategies to maintain a higher withdrawal rate and the risks associated with this.

This may also include the purchase of annuities, to manage longevity risk (the risk of running out of money in retirement) rather than from the perspective of boosting current portfolio income.

Morningstar suggests that new retirees “should be conservative on the withdrawal rate front, especially because the much-cited “4% guideline” for portfolio withdrawal rates is based on market history that has never featured the current combination of low yields and not-inexpensive equity valuations.”

The 4% withdrawal rate is an industry “rule of thumb”. Further discussion on the sustainability of the 4% withdrawal rate can be found here.

I have posted extensively about the low expected return environment and the challenges this creates for the Traditional Portfolio of 60% Equities and 40% Fixed Income.

The following Post on what investors should consider doing in the current market environment may be of interest. This Post outlines some investment strategies which may help in maintaining a higher withdrawal rate from an investment portfolio.

Likewise, this Post on how greater customisation of the client’s invest solution is required and who would benefit most from targeted investment advice may also be of interest.

Lastly, Wealth Management.com covers Benz’ article in Retirement Planning in a Pandemic.

Please read my Disclosure Statement