At this time of the year there are a plethora of economic and market forecasts for next year. This Post is not one of them.

Outlined below are several investment strategies investors should consider in building more robust portfolios for the years ahead and to increase the odds of meeting their investment objectives.

These strategies directly address the current investment environment and the developing theme over 2020 that the traditional Balanced portfolio, of 60% equities and 40% fixed income, is facing several head winds, and likely to disappoint from a return perspective in the decade ahead.

A recent FT article captures this mood, titled: Investors wonder if the 60/40 portfolio has a future | Financial Times

In the article they make the following comment “The traditional 60/40 portfolio — the mix of equities and bonds that has been a mainstay of investment strategy for decades — is at risk of becoming obsolete as some investors predict years of underperformance by both its component parts.”

I first Posted about the potential demise of the Balanced Portfolio in 2019, see here, and again in early 2020, see here. These Posts provide background as too why many investment professionals are questioning the likely robustness of the Balance Portfolio in the years ahead given the current investment environment.

In essence, there are two themes presented for the bleak outlook for the Balanced Portfolio.

The first is that fixed income and equities (mainly US equities) are expensive, so now may not be a great time to invest in these markets.

The second theme is that with interest rates at very low levels, there is doubt that fixed income can still effectively protect equity portfolios in a severe market decline in ways they have done historically.

For more on the low expected return environment, first Theme, see these Posts here and here. This Post also outlines that although markets fell sharply in March 2020, forecast future returns remain disappointing.

The strategies discussed below address the second theme, the expected reduced effectiveness of fixed income to protect the Balance Portfolio at the time of severe sharemarket declines.

The Balance Portfolio has served investors well. Although equities and fixed income still have a role to play in the future, there is more that can be done.

The strategies outlined below are “the more that can be done“, they aim to improve the risk and return outcomes for the Balance Portfolio in the years ahead.

For the record, I anticipate the global economy to continue to repair next year, experiencing above average growth fuelled by the roll out of the Covid-19 vaccines and underpinned by extraordinary low interest rates and generous government spending programs. Global equities will continue to perform well in this environment, the US dollar will weaken further, commodity prices will move higher, value and emerging markets to outperform.

Before looking at some of the strategies to improve on the Balance Portfolio, it goes without saying there is a role for equities in most portfolios. The case for and against US equities are found here and here respectively.

There is also a role for holding Fixed Income securities, primarily government bonds.

This Post reviews some of the reasons why owning government bonds makes good sense in today’s investment and economic climate. It also brings some balance to present discussions around fixed income and the points within should be considered when determining portfolio allocations in the current market environment.

The central argument for holding government bonds within a portfolio: Government bonds are the only asset where you know with absolute certainty the amount of income you will get over its life and how much it will be worth on maturity. For most other assets, you will only ever know the true return in arrears.

In a recent Financial Times article PIMCO argues the case for the 60/40 portfolio in equities and fixed income.

In relation to fixed income they argue, that although “returns over the horizon may be harder to achieve, but bonds will still play a very important role in portfolios”. The benefits being diversification and moderation of portfolio volatility.

However, they argue in relation to fixed income investors must target specific regions and parts of the yield curve (different maturity dates) to maximise return and diversification potential.

PIMCO see opportunities in high-quality assets such as mortgage-backed securities from US government agencies, areas of AA and AAA rated investment-grade corporate bonds, and emerging market debt that is currency hedged.

They conclude: “One answer for 60/40 portfolio investors is to divide fixed-income investments into two subcomponents — hedging and yield assets.”

This Post outlines a thinkadvisor.com article which provides a framework to consider potential investment ideas in the current extremely low interest rate environment, by examining the 40% fixed income allocation within the 60/40 Portfolio (Balanced Portfolio).

The basis of the article is that investors seeking to generate higher returns are going to have to look for new sources of income, allocate to new asset classes, and potentially take on more risk. This likely involves investing into a broader array of fixed income securities, dividend-paying equities, and alternatives, such as real assets and private credit.

I have no doubt investors are going to have to look for alternative sources of returns and new asset classes outside equities and fixed income over the next decade.

Not only will this help in increasing the odds of meeting investment objectives, but it will also help protect portfolios in periods of severe sharemarket declines, thus reducing portfolio volatility, a role traditionally played by fixed income within a multi-asset portfolio.

The best way to manage periods of severe sharemarket declines, as experienced in the first quarter of 2020, is to have a diversified portfolio. It is impossible to time these episodes.

AQR has evaluated the effectiveness of diversifying investments during market drawdowns.

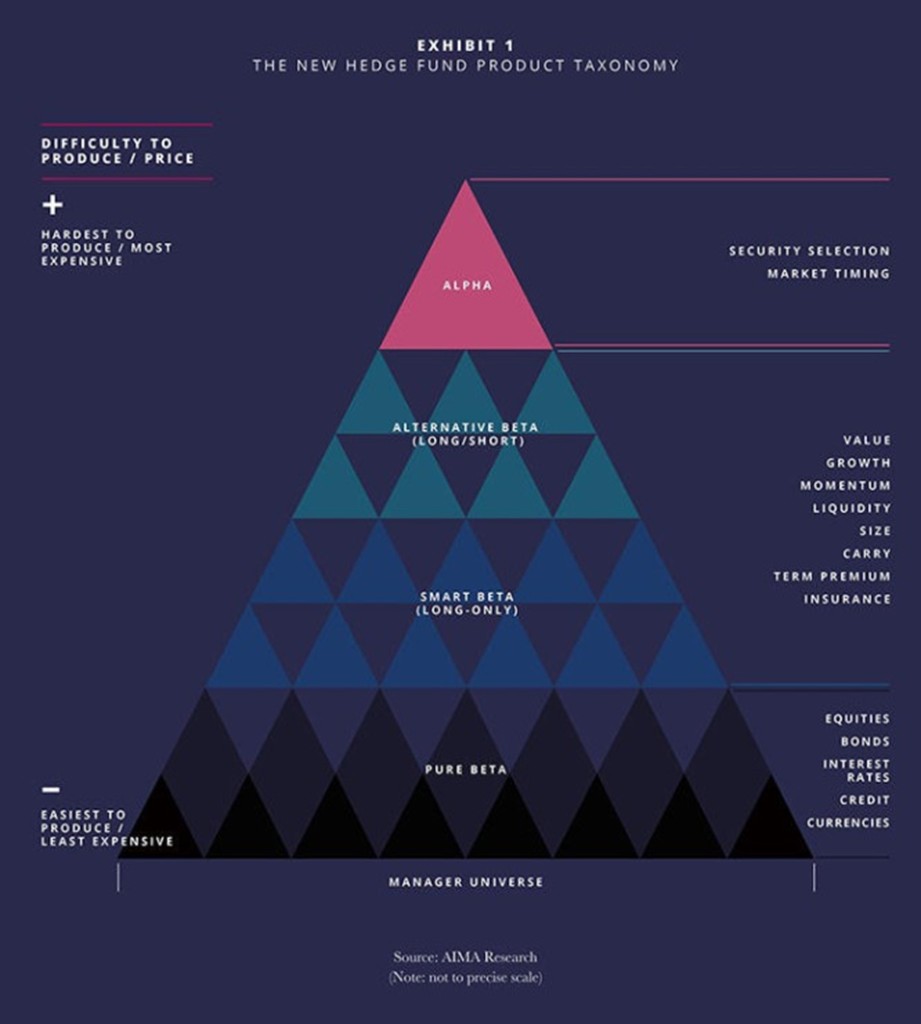

They recommend adding investments that make money on average and have a low correlation to equities i.e. liquid alternatives and hedge fund type strategies.

AQR argue diversification should be true in both normal times and when most needed: during tough periods for equities. Although “hedges”, e.g. Gold, may make money at times of sharemarket crashes, there is a cost, they tend to do worse on average over the longer term.

Alternative investments are more compelling relative to the traditional asset classes in diversifying a portfolio, they provide the benefits of diversification and have higher returns.

Lastly, Portfolio diversification involves adding new “risks” to a portfolio, this can be hard to comprehend. Diversification can be harder to achieve in practice than in theory.

This Post provides a full summary and access to the AQR article.

The case for Trend (momentum) Strategies

A sub-set of Alternatives and hedge funds is Trend/Momentum.

In this recent article MAN present the benefits of introducing Trend following strategies to the traditional Balanced Portfolio. Man note, “Another element that we believe can be of great help to bond-equity portfolios in the future is time-series momentum, or trend-following.”

Their analysis highlights that adding trend-following results in a significant improvement relation to the Balanced Portfolio, by improving returns, decreases volatility, and reducing the degree of losses when experienced (lower downside risk – drawdowns).

The expected reduced diversification benefits of fixed income in a Portfolio is a growing view among many investment professionals.

This presents a very important portfolio construction challenge to address, particularly for those portfolios with high allocations to fixed income.

There are many ways to approach this challenge,

This Post focuses on the case for Tail Risk Hedging. It also outlines other approaches.

In my mind, investment strategies to address the current portfolio challenge need to be considered. The path taken is likely to be determined by individual circumstances.

On this note, the complexity, and different approaches to providing portfolio protection, was highlighted by a twitter spat between Nassim Nicholas Taleb (Tail Risk Hedging) and Cliff Asness (broad Portfolio Diversification) from earlier in the year.

I provide a summary of this debate in Table format accessed in this Post, based on a Bloomberg article.

Several learnings can be gained from their “discussion”.

Also covered the Post was an article by PIMCO on Hedging for Different Market Scenarios. This provides another perspective and a summary of different strategies and their trade-offs in different market environments.

Not every type of risk-mitigating strategy can be expected to work in every type of market environment.

Therefore, maintaining an array of diversification strategies is preferred “investors should diversify their diversifiers”.

Vanguard recently concluded that investors should carefully consider liquid alternatives and hedge funds.

This is a very good article presenting the benefits Alternatives would bring to a Balanced Portfolio.

Their research highlighted that Hedge Funds and Liquid Alternatives both bring portfolio diversification benefits to a traditional portfolio of equities and fixed income.

They suggest that liquid alternatives are often viable options for investors compared to hedge funds.

Although hedge funds and liquid alternatives deliver valuable portfolio diversification benefits, “it is crucial that investors assess funds on a standalone basis, as the benefits from any alternative investment allocation will be dictated by the specific strategy of the manager(s).”

The most important feature in gaining the benefits of hedge funds and liquid alternatives is manager selection. Implementation is key.

Access to this research can be found here.

For those investors that can invest into illiquid investments, Private Equity (PE) is an option.

Portfolio analysis, also undertaken by Vanguard, demonstrates that PE can play a significant role in strategic, long-term, diversified portfolios.

PE is illiquid and so must be actively managed, introducing both illiquidity and manager specific risk to a multi-asset portfolio. Conventional asset allocation approaches often omit illiquidity and active risk dimensions from the risk-return trade-off. Therefore, these models do not reflect the unique aspects of PE and tend to over allocate to PE.

Vanguard addresses these issues: outlining four key reasons why the economic returns of private equity are different to those of public equities; highlighting the key risks that need to be accounted for when undertaking portfolio modelling including illiquid assets such as PE; and presenting the adjustments they make to portfolio modelling to address the illiquid features of PE and smoothed nature of historical returns.

This results in more realistic characteristics for PE that can be used for portfolio modelling purposes, reflected in the portfolio allocations generated in the article and the conclusion that PE can play a significant role in strategic, long-term, diversified portfolios.

A review of Vanguard’s analysis and their results can be found in this Post.

Real assets such as Farmland, Timberland, Infrastructure, Natural Resources, Real Estate, Inflation-linked Bonds, Commodities, and Foreign Currencies offer real diversification benefits to a portfolio of just equities and fixed income.

The benefits of Real Assets are noticeable in different economic environments, like stagflation and stagnation, and particularly for those investment portfolios where objectives are linked to inflation.

These are the conclusions of a recent study by PGIM.

PGIM provide a brief outline of the investment characteristics for several real assets. They then look at the sensitivity of the real assets to economic growth, inflation, equity markets, and fixed income.

They note there is wide diversity in real assets’ sensitivities to inflation and growth, and stocks and bonds. These sensitivities vary over time and are best mitigated by holding a portfolio of real assets.

Therefore, PGIM construct and analyse three real asset strategy portfolios – Diversification, Inflation-Protection and Stagnation-Protection to reach their conclusions.

I provide a detailed summary of the PGIM Report in this Post.

Portfolio Tilts

Adding Emerging Markets and Value tilts to a Portfolio are potential areas to boost future investment returns in what is likely to be a low return environment over the next decade.

Value of Emerging Markets

Emerging markets bring the benefits of diversification into different geographies and asset classes for investors, including both public and private markets.

The case for investing into emerging markets is well documented: a growing share of global economic activity in the years ahead and current attractive valuations underpin the case for considering a higher weighting to emerging markets within portfolios. Particularly considering the low interest rate environment and stretched valuation of the US sharemarket. This is evident in market return forecasts.

Is a Value bias part of the answer in navigating today’s low interest rate environment

Value offers the potential for additional returns relative to the broader sharemarket in the years ahead.

Value is exceptionally cheap, probably the cheapest it has ever been in history, based on several valuation measures and after making adjustments to market indices to try and prove otherwise, such as excluding all Technology, Media, and Telecom Stocks, excluding the largest stocks, and the most expensive stocks.

There is also little evidence to support the common criticisms of value, such as increased share repurchase activity, low interest rates, and rise of intangible assets.

This is not a popular view, and quite likely minority view, given the underperformance of value over the last ten years.

However, the longer-term odds are in favour of maintaining a value tilt and thereby providing a boost to future investment returns in what is likely to be a low return environment over the next decade.

Please see my Disclosure Statement

Global Investment Ideas from New Zealand. Building more Robust Investment Portfolios.