Kiwi Investor Blog has published over 150 Posts, so far!

Thank you to those who have provided support, encouragement, and feedback. It has been greatly appreciated. Kiwi Investor Blog achieved 100 Posts in October 2019.

Consistent with the current investment environment and the outlook for future investment returns, the key themes of the Kiwi Investor Blog Posts over the last twelve months have been:

- Future returns are unlikely to be as strong as those experienced over the last decade

- Investment strategies for the next decade likely to include real assets, tail risk hedging, and a greater allocation to alternatives e.g. Private Equity

- What portfolio diversification is, and looks like

- Positioning portfolios for the likelihood of higher levels of inflation in the future

- Time to move away from the traditional Diversified Balanced Portfolio

- Occasions when active Management is appropriate and where to find the more consistently performing managers – who outperform

- Investing for Endowments, Charities, and Foundations

- Navigating a Bear market, including the benefits of disciplined portfolio rebalancing

Links to the key Posts to each of these themes is provided below.

Kiwi Investor Blog’s primary objective is to make available insights into Institutional investment strategies, practices, and processes to a wider audience in simple language.

The Posts are written in the spirit of encouraging industry debate, challenging the status quo and “conventional wisdoms”, and striving to improve investment outcomes for clients.

Future returns are unlikely to be as strong as those experienced over the last decade

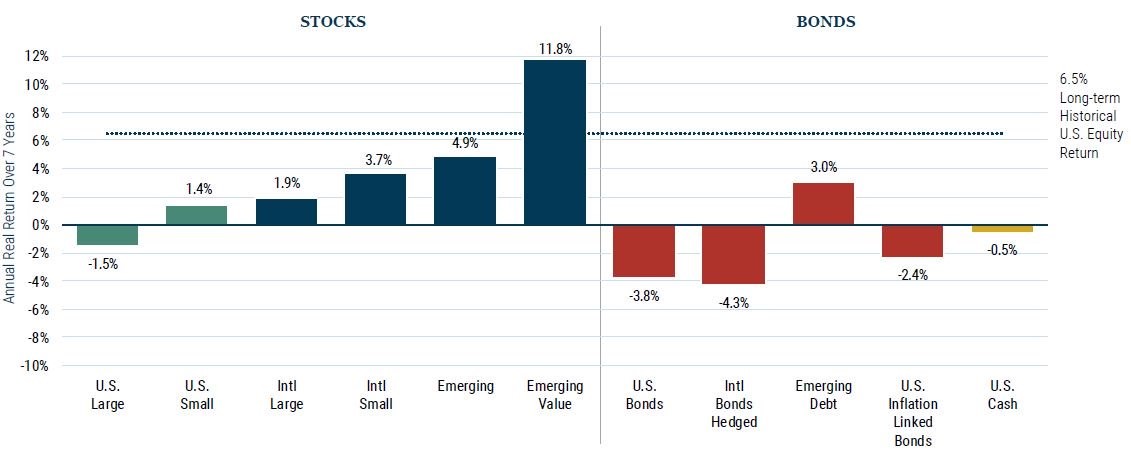

The year started with a sobering outlook for long-term investment returns as outlined in this article by AQR. The long-term outlook for investment markets has been a dominant theme this year, where the strong returns experienced over the Past Decade are unlikely to be repeated in the next 10 years. Also see a related Bloomberg article here.

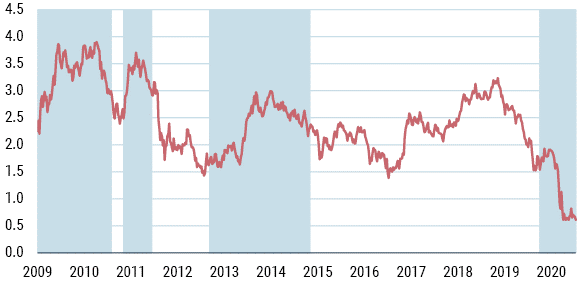

Interestingly, even after the strong declines in March and April of this year, Forecasted investment returns remain disappointing, given the nature of longer-term market returns.

If anything, the outlook for fixed income returns has deteriorated over the course of 2020.

Investment strategies for the next decade likely to include real assets, tail risk hedging, and a greater allocation to Alternatives

The challenging return environment led to a series of Posts on potential investment strategies to protect your Portfolio from different market environments in the future.

This includes the potential benefits of Tail Risk Hedging and an allocation to Real Assets.

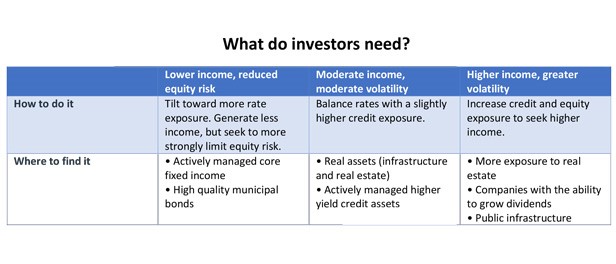

A primary focus of many investment professions currently is what to do with the fixed income allocations of portfolios, as outlined in this article.

This series of Posts also included the case against investing in US equities and the case for investing in US equities (based on 10 reasons by Goldman Sachs that the current US Bull market has further to run).

The investment case for a continued allocation to Government Bonds was also provided.

Theses Post are consistent with the global trend toward the increasing allocations toward alternatives within investment portfolios. This survey by CAIA highlights the attraction of alternatives to investors and likely future trends of this growing investment universe, including greater allocations to Private Equity and Venture Capital.

One of the most read Post this year has been a comparison between Hedge Funds and Liquid Alternatives by Vanguard, with their paper concluded both bring diversification benefits to a traditional portfolio.

What Portfolio Diversification is, and looks like

Reflecting the current investment environment and outlook for investment returns, recent Posts have focused on the topic of Portfolio Diversification. These Posts have complemented the Posts above on particular investment strategies.

A different perspective was provided with a look at the psychology of Portfolio Diversification. Diversification is hard in practice, easy in theory, it often involves the introduction of new risks into a Portfolio and there is always something “underperforming” in a truly diversified portfolio. This was one of the most read Posts over the last six months.

A Post covered what does portfolio diversification look like. A beginner’s guide to Portfolio diversification and why portfolios fail was also provided.

On a lighter note, the diversification of the New Zealand Super Fund was compared to the Australian Future Fund (both nation’s Sovereign Wealth Funds).

A short history of portfolio diversification was also provided, and was read widely.

The final Post in this series provided an understanding of the impact of market volatility on a Portfolio.

Positioning Portfolios for the likelihood of higher levels of inflation in the future

Investors face the prospects of higher inflation in the future. Although inflation may not be an immediate threat, this article by Man strongly suggests investors should start preparing their Portfolio for a period of higher inflation.

The challenge of the current environment is also covered in this Post, which provides suggestions for Asset Allocations decisions for the conundrum of inflation or deflation.

Time to move away from the traditional Diversified Portfolio

A key theme underpinning some of the Posts above is the move away from the traditional Diversified Portfolio (the 60/40 Portfolio, being 60% Equities and 40% Fixed Income, referred to as the Balance Portfolio).

Posts of interest include why the Balanced Portfolio is expected to underperform and why it is time to move away from the Balanced Portfolio. They are likely riskier than you think.

There has been a growing theme over the last nine months of the Reported death of the 60/40 Portfolio.

My most recent Post (#152) highlights that the Traditional Diversified Fund is outdated as it lacks the ability to customise to the client’s individual needs. Modern day investment solutions need to be more customised, particularly for those near and in retirement.

Occasions when active Management is appropriate and where to find the more consistently performing managers

Recent Posts have also covered the role of active management.

They started with a Post with my “colour” on the active vs passive debate (50 shades of Grey), after Kiwi Wealth got caught up in an active storm.

RBC Global Active Management provided a strong case for the opportunities of active management and its role within a truly diversified portfolio.

While this Post covered several situations when passive management is not appropriate and different approaches should be considered.

Another popular Post was on where investment managers who consistently outperform can be found.

Investing for Endowments, Charities, and Foundations

I have written several Posts on investing for Endowments, Charities, and Foundations.

This included a Post on the key learnings from the successful management of the Yale Endowment.

How smaller Foundations and Charities are increasingly investing like larger endowments. See here and here.

Navigating a Bear market, including the benefits of disciplined Portfolio rebalancing

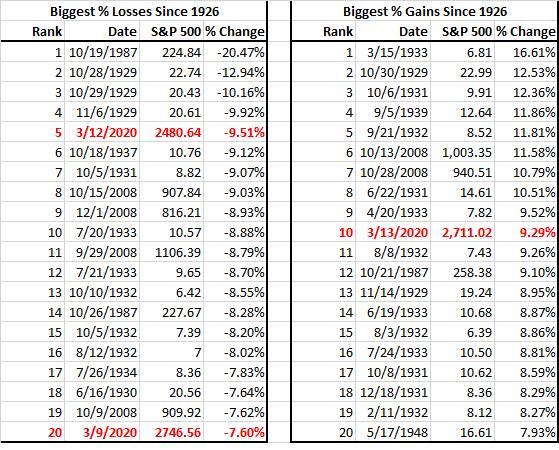

Not surprisingly, there have been several Posts on navigating the Bear Market experienced in March and April of this year.

Posts on navigating the event driven Bear Market can be found here and here.

The following Post outlined what works best in minimising loses, market timing or diversification at the time of sharemarket crashes.

This Post highlighted the benefits of remaining disciplined during periods of market volatility, even as extreme as experienced this year, particularly the benefits of Rebalancing Portfolios.

Please see my Disclosure Statement

Global Investment Ideas from New Zealand. Building more Robust Investment Portfolios.